Export stakeholders

-

News

-

French export credit refinancing scheme 2021

15 October, 2021 -

Our key figures

Key figures

30banks partners31concluded deals17,9 B€closed refinancing -

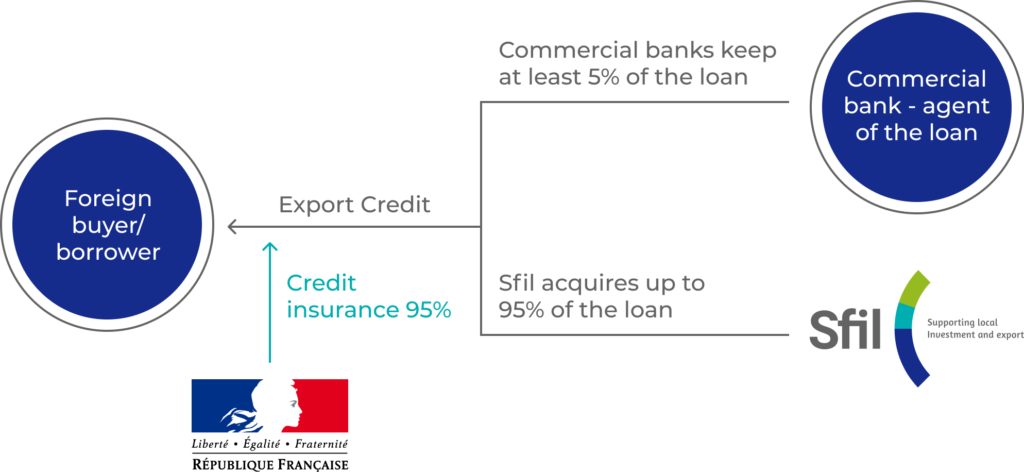

Sfil's export credit set-up:

the combination of 3 expertizes for the benefit of the borrower– Structuration: top arranging banks selected by the borrower via a competitive process

– Credit risk: Bpifrance Assurance Export insurance policy with the guarantee of the French Sovereign

– Liquidity: additional capacity brought by Sfil at very competitive terms -

Sfil : a booster to improve competitiveness

-

Benefits of Sfil set-up

The set-up contributes to improve the quality of French export offer in terms of:

Amount

We provide liquidity in addition to banking capacities without any limit on amount per project

3 billion EUR expected average annual contribution

Maturity

We intervene on maturities up to 30 years, including:

1) construction period

2) amortization period

(on the basis of OECD Arrangement limits)

Cost

The impact on the prices is due to:

1) Sfil’s exceptional access to international capital markets

2) the increase in number and volume of competitive offers from the banksWithout Sfil, the biggest French shipyard could not simultaneously implement 4 billion euros commercial contracts

-

Intervention conditions

Sfil’s intervention is aimed at projects under negotiation:

- From all sectors and all countries

- Amounting to 70 million euros and above

- Financing France based exporting companies and therefore eligible to Bpifrance Assurance Export’s credit insurance

- Meeting the European Commission’s requirements

Read more

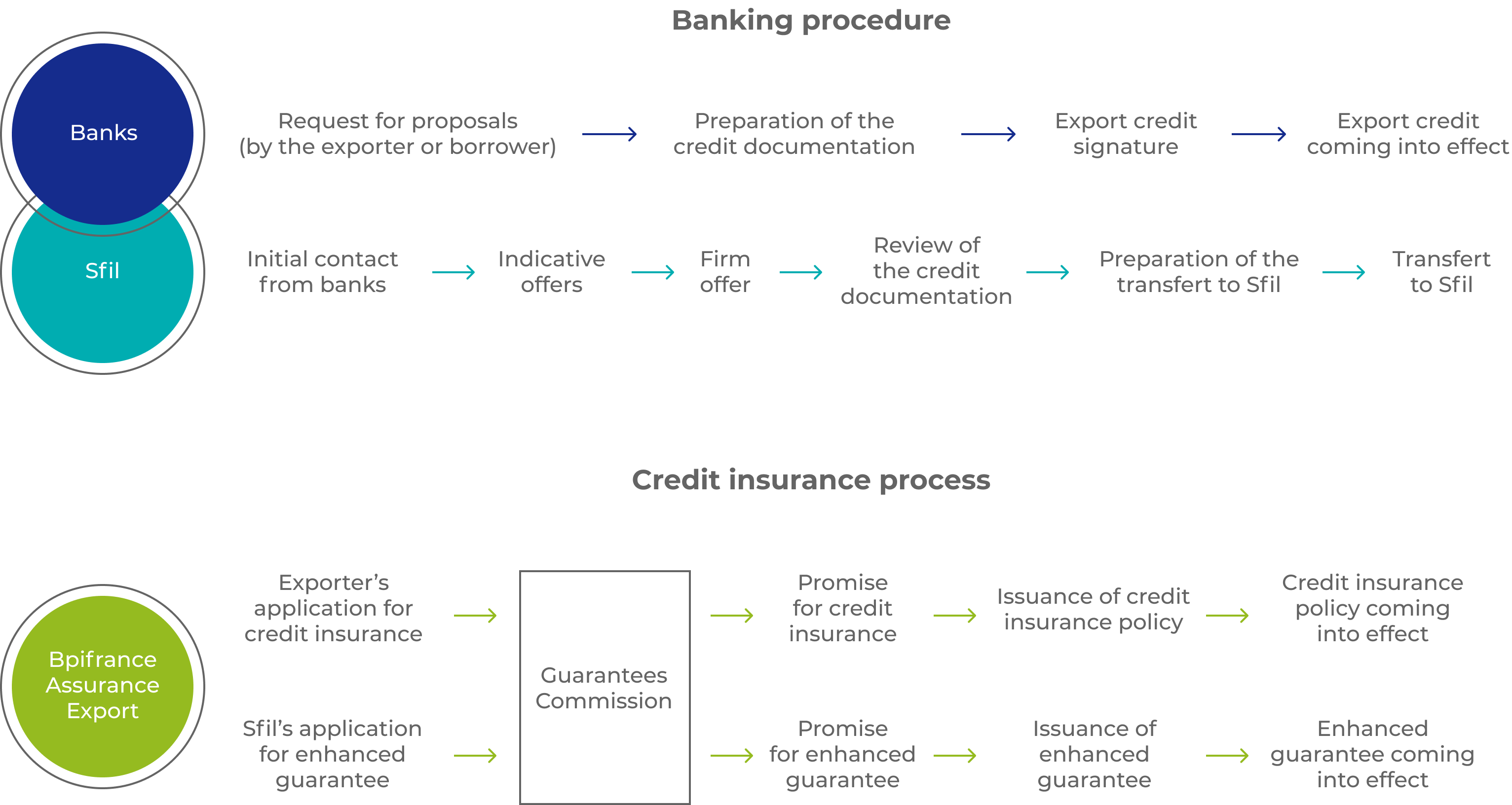

For each project, Sfil has to comply with the European Union’s requirements, including:

- Transferring a portion of the credit to Sfil must be carried out within 3 months following the export credit signature.

- The borrower or exporter must state how many banks were consulted for the transaction.

1st case: the borrower or exporter consults banks in order to select the pool of initial lenders

The number of banks consulted to be initial lenders must reach (number of banks refinanced by Sfil + 1) for nuclear, defense or projects above 500 million euros or (number of banks refinanced by Sfil + 2) for all other projects.2nd case: the borrower or exporter consults banks in order to select the arranging bank(s) to syndicate the loan

The number of banks consulted to arrange and syndicate the loan must reach (number of arranging banks + 1) for nuclear, defense or projects above 500 million euros or (number of arranging banks + 2) for all other projects.Specific case with a unique lender: the number of banks consulted by the exporter or the borrower for that project must reach 2 for nuclear, defense or projects above 500 million euros or 3 for all other projects.

More details on: http://ec.europa.eu/competition/state_aid/cases/257147/257147_1665498_189_2.pdf (page 21 – article 1.4) -

Steps to get refinancing from Sfil

Participation of Philippe Mills at TXF Global Virtual on June 10, 2021

-

A close cooperation with banks for the benefit of the French industry and their customers

Publications

Contacts

Useful links

-

Last update 28/08/2024